Walmart is the heavyweight in this lineup. It is one of the biggest retailers in the world, with a huge store network on the ground and a fast-growing online marketplace on top of it. Global ecommerce sales have already passed 100 billion dollars, and Walmart holds around 6.4% of the entire US ecommerce market, second only to Amazon.

Walmart Marketplace: Breakdown and Strategic Context

You can’t talk about e-commerce without mentioning Walmart. Known primarily for its physical stores, Walmart has rapidly evolved into the second-largest online marketplace in the U.S. – right behind Amazon. And it’s not slowing down. With operations already live in Canada, Mexico, and Chile, and a London office opened in late 2025, Walmart is clearly laying the groundwork for further international expansion.

By 2025, Walmart’s eCommerce revenue hit over $53 billion in the U.S. The platform pulls in 400+ million monthly visits, and most of its catalog – over 420 million items – is from third-party sellers. Unlike Amazon, though, the competition isn’t as cutthroat. Around 200,000 sellers live on the platform, which means more visibility and a better chance to stand out.

Why does Walmart stand out? Reach. It has 4,600+ U.S. stores that aren’t just retail spaces – they support in-store returns, same-day delivery, and Buy Online Pick Up In Store (BOPIS). On the logistics side, WFS (Walmart Fulfillment Services) offers fast, affordable fulfillment, boosting both placement and conversion. For ads, Walmart Connect delivers Sponsored Search, banners, and automated campaign tools – plus CPCs often lower than Amazon’s.

Top-selling categories include electronics, toys, baby, home, grocery, and pet supplies. Walmart is also expanding into higher-margin verticals like premium beauty and certified refurbished goods. “Resold at Walmart” is their pre-owned section, now open to select categories like fashion and gadgets.

Pricing is simple: no subscription fees – just category-based referral fees between 6% and 15%. You can find more information here. If you opt into WFS, you’ll pay for storage and shipping, but the rates are competitive.

If you want exposure, fast shipping, and reliable volume, it’s a strong, stable platform.

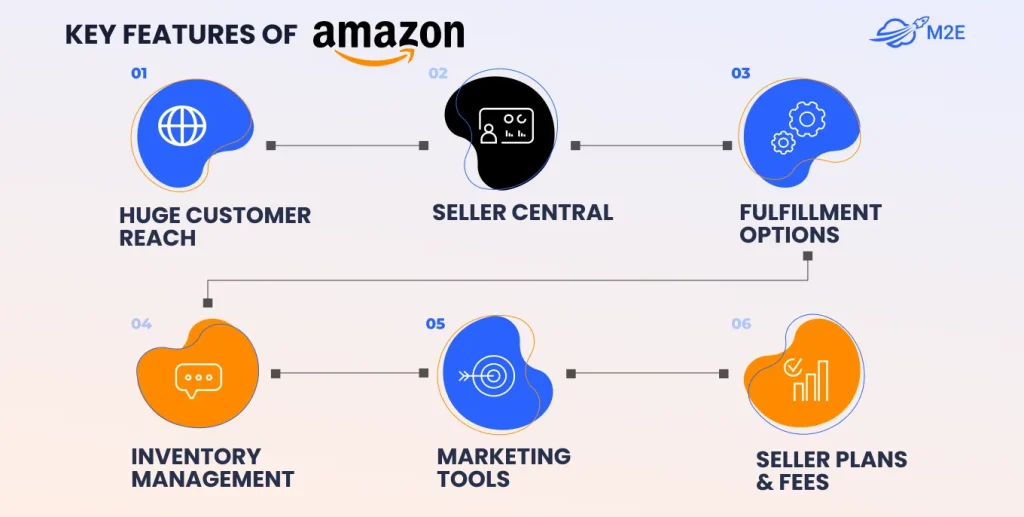

Amazon Marketplace

Amazon has been setting its own standards for years, and it remains Walmart’s biggest competitor in the US. More than 60 percent of Amazon’s sales come from third-party sellers, and in 2024 alone, over 55,000 of them passed the one million dollar mark in annual revenue.

Why do so many sellers still choose Amazon? The answer is reach, trust, and powerful infrastructure.

That infrastructure starts with fulfillment. Fulfillment is simple with Fulfillment by Amazon, or FBA. Amazon stores your products, picks and packs orders, ships them to customers, and handles customer service and returns.

That infrastructure also extends beyond Amazon’s marketplace through Multi-Channel Fulfillment (MCF). MCF lets you ship orders that come from your own online store and even from other marketplaces. It is convenient, but both FBA and MCF include fees for storage, picking, packing, and shipping. Some media items also include a closing fee, and you may face storage overage charges. In total, thirty to fifty percent of your margin can disappear into fulfillment and platform costs. You can check our detailed guide on Amazon MCF fees in 2025 to understand the real cost structure and protect your margins.

The Professional selling plan costs 39.99 dollars per month. Amazon then charges a referral fee on each item sold, typically between 8 and 15 percent, with some categories, such as Accessories, reaching 45 percent.

Amazon covers almost every major shopping category, including Electronics, Home and Kitchen, Beauty, Books, Clothing, Sports and Outdoors, and Pet Supplies. Some categories require seller approval, for example, Jewelry and Grocery, and others are heavily gated, such as Fine Art and certain Collectibles.

The trade-off is control. You are building your business inside Amazon’s ecosystem, which means you do not own the customer relationship and you depend on Amazon’s rules, algorithms, and policies.

Getting started is not easy, but if you are already selling online and want to scale, Amazon gives you the infrastructure to build a high-volume business. The opportunity is big, but it also requires consistent work and focus.

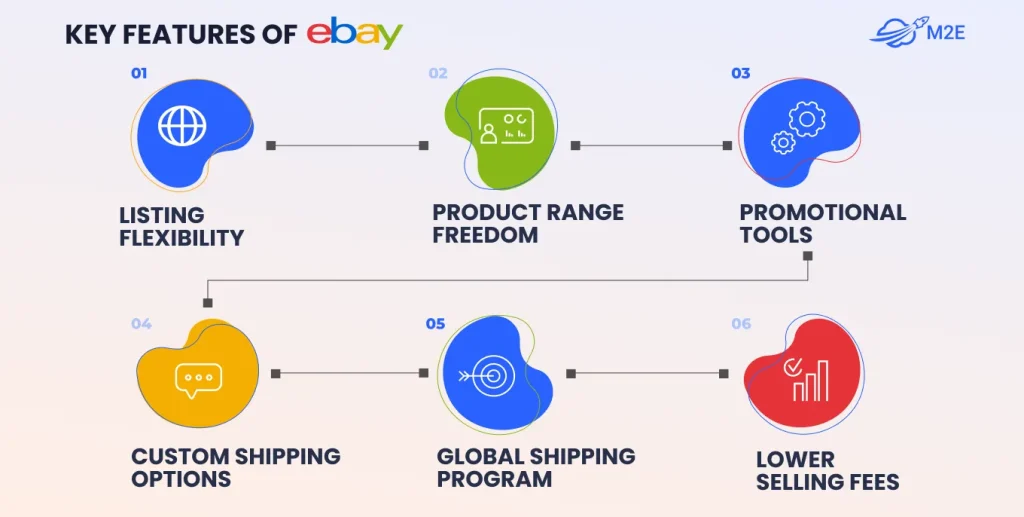

eBay

Everyone knows eBay. Launched in 1995, it’s one of the original online marketplaces, and it still pulls in over 135 million buyers looking for everything from everyday essentials to rare, niche parts and collectibles. For business sellers, that audience is not just “big” – it is structured, searchable demand you can actually plug into.

Compared with Walmart, eBay continues to onboard straightforwardly. You register a business account, add your company details, tax information, and bank account, go through standard verification, and you are ready to sell. There is real onboarding, but without Walmart’s long approval cycles or strict entry criteria. Once you are in, you get proper seller tooling: you control shipping, pricing, and returns through eBay’s Business Policies, which let you create reusable templates for your shipping, payment, and return rules.

eBay features broad categories like Electronics, Fashion, Home & Garden, Motors, Collectibles, Toys & Hobbies, Health & Beauty, and Sporting Goods, with many subcategories for specific items. Where eBay really pulls ahead for many businesses is eBay Motors. If you sell auto parts, this is often the marketplace’s number one. Fitment tools let you map a single part to hundreds of compatible vehicles, so buyers see only what actually fits their car.

eBay business pricing includes monthly store subscriptions (like Starter from $4.95/mo) for better fee rates and more listings, plus Final Value Fees (usually 6.9%–13.6%, depending on category) and a flat $0.30 per-order charge. That’s calculated from the full transaction total (item, shipping, and tax). Our guide breaks down all the seller fees – final value fees, listing costs, payment processing, and more – so you can price smarter and stay profitable.

If you want a verified business setup, fast access to a huge global buyer base, and a platform that already owns the auto parts search mindset, eBay delivers. It is not trying to be Walmart – and for a lot of business sellers, especially in parts and long-tail inventory, that is exactly why it works.

TikTok Shop

TikTok Shop isn’t built like a traditional marketplace – and that’s exactly the point. Instead of buyers searching for products, the platform pushes content: users scroll, spot something interesting, and buy it without ever leaving the app. While TikTok might seem like a Gen Z playground, it is rapidly becoming a serious sales channel for all kinds of sellers – from small local brands to global eCommerce businesses.

TikTok Shop’s revenue (Gross Merchandise Value – GMV) grew rapidly in 2025, projected to hit around $66 billion globally, nearly doubling from 2024. As of August 2025, TikTok provides a separate Seller Center for each country where the platform is active. Full selling features are already live in the U.S., U.K., and much of Western Europe. Like Walmart, TikTok is also focusing on Latin American countries. It has already launched in Brazil and plans to open in Chile and Argentina.

TikTok’s impact on buying decisions is also hard to ignore. Trends like #tiktokmademebuyit aren’t just hashtags – they’re sales funnels. One viral video can send thousands of orders to a single product in a matter of hours. And with in-app checkout, users don’t think twice. TikTok’s Shopping Tab pulls all product-related content into one place, making it easier for users to browse and buy. For sellers, collaboration with influencers often drives better results than paid ads elsewhere, thanks to the platform’s authenticity-first culture.

TikTok Shop covers categories like beauty, fashion, gadgets, home goods, and even food. Commissions hover around 9% of the total order value (item price + shipping + discounts), depending on category and region. No monthly fees, and onboarding is straightforward.

Walmart is all about infrastructure, search, and reliable delivery. It works well for sellers who focus on operations, pricing, and consistency. TikTok is the opposite. It runs on influence, discovery, and speed. It rewards sellers who move quickly, follow trends, and act as soon as the algorithm starts pushing their products. In reality, the strongest results now come from using both. Walmart brings steady, search-driven demand, while TikTok adds bursts of visibility and fast-moving sales. Sellers who combine these two very different channels usually win more than those who rely on just one.

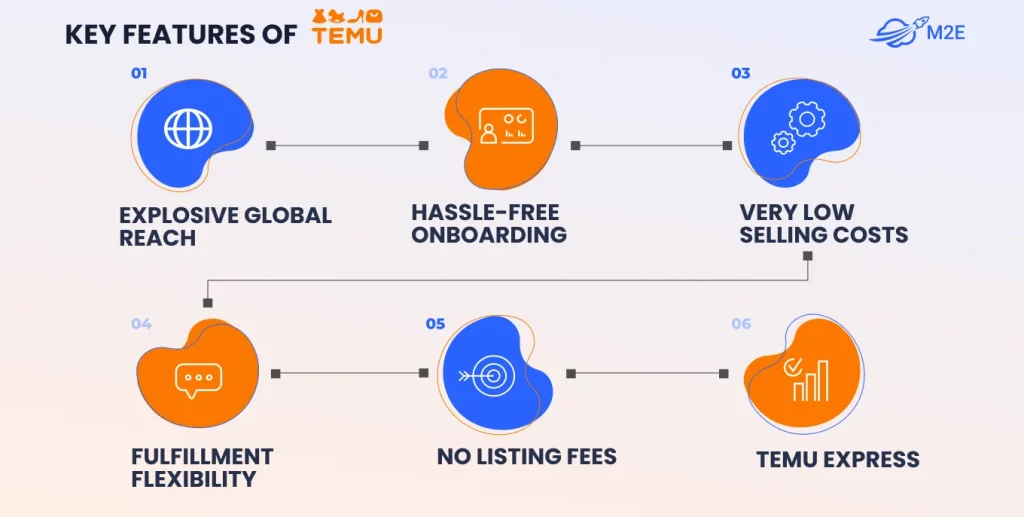

Temu burst onto the US market in 2022 and quickly became one of the most downloaded shopping apps. It is scaling globally, opening up opportunities for local sellers and brands in a growing number of countries and markets.

Temu

They win over their users with a special pricing strategy, innovative marketing, and an interesting business model. Temu gives its sellers and brands access to a huge number of active buyers.

On Temu, you are not limited to product categories. It satisfies a very wide range of businesses. You can sell fashion products, household appliances, household goods and essentials, hygiene or beauty products – anything you want. Temu offers a low-cost entry for businesses, with no listing, registration, or subscription fees.

Setting up is very simple – you do not need complicated documentation or long waiting periods. Just create your account, fill out the necessary documents, and get approved. Everything is optimized for the seller. If you encounter any difficulties, a special support team will help you, who will be able to accompany you at every stage, as well as provide advice.

What makes it different from other platforms? First of all, competitive pricing. It is an ideal platform for price-sensitive buyers. This is possible thanks to Temu’s optimized supply chain, wholesale discounts, and strategic tactics.

In addition, Temu allows sellers to significantly reduce costs for setup, daily operations, and additional marketing tools. For companies looking to add another sales channel without a significant investment, this looks like an attractive option.

Sellers who use both often gain the advantage: Walmart offers stable, search-driven demand, and Temu provides an easier path to expand into new markets without heavy upfront investment.

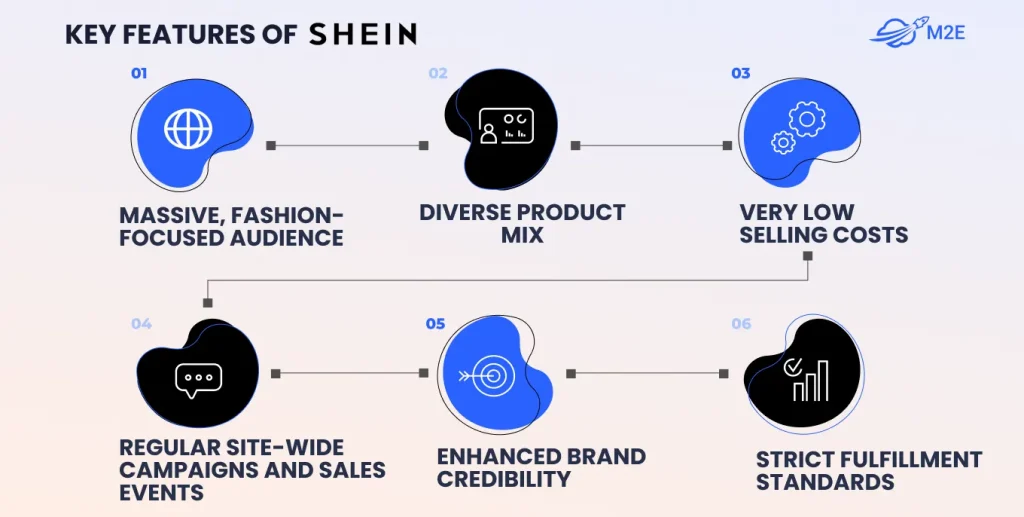

SHEIN Marketplace

With over 150 million app downloads and a presence in 150+ countries, SHEIN connects sellers directly to a young, trend-hungry audience. In the first half of 2025 alone, the SHEIN app racked up over 85 million downloads, and Q1 sales came close to $10 billion. That kind of reach makes it one of the most promising platforms for sellers looking to tap into a trend-driven global audience.

The first thing that comes to mind when we talk about SHEIN Marketplace is clothing, accessories, and fashion. In fact, SHEIN is not far behind Walmart in terms of categories. These include Home decor, Household Appliances, Electronics & Tech Accessories, Pet Supplies, Office & School Supplies, and even Automotive.

What makes SHEIN appealing to businesses? For one, the audience is massive and highly engaged, especially in categories like apparel, beauty, home, and lifestyle. SHEIN gives sellers a streamlined onboarding process, in-app product discovery, and international reach through a centralized platform.

First, fees. SHEIN Marketplace offers a low-cost, seller-friendly environment to help your business scale. Sellers get a 0% commission period when starting. After that, commissions typically range between 10 -25%, depending on the category and region. There are no listing or subscription fees, which means a much lower barrier to entry. Check our full breakdown here.

Thirdly, the infrastructure. SHEIN handles payments, cross-border logistics, and returns, making international selling easier, especially for brands without their own fulfillment network.

For sellers, Walmart rewards strong operations, reliable fulfilment, and competitive pricing in core retail categories. SHEIN rewards speed on trends, fresh assortments, and strong visuals that convert in a mobile app. Used together, they can complement each other: Walmart helps you build steady, search-based demand, while SHEIN opens the door to a younger, trend-focused global audience without requiring you to build your own cross-border infrastructure.

Etsy

Etsy doesn’t really compete with Walmart in the traditional sense. You won’t find groceries or mass-market electronics here. But if you’re selling handmade, vintage, or one-of-a-kind goods, it’s probably the best place to be.

Getting started is simple. You can open a shop today and live in minutes. This low barrier makes Etsy especially appealing for new sellers testing ideas or building a creative side business.

The real strength lies in the audience. Etsy buyers aren’t just shopping- they’re looking for something different. Whether it’s custom jewelry, personalized gifts, art prints, or vintage finds, the demand is strong and very specific. That focus helps sellers with unique products get noticed without getting buried under mass-produced competition, like on Walmart or Amazon.

Etsy business fees involve a few core costs: a $0.20 listing fee per item, a 6.5% transaction fee on the total sale (including shipping), and a payment processing fee (around 3% + $0.25, varying by country) for Etsy Payments.

Still, for artists, makers, and niche sellers, Etsy hits the sweet spot. It’s not about scale – it’s about connection. The shoppers here want a story, not just price. Walmart can’t really offer that.

Macy’s Marketplace

Macy’s launched its marketplace in 2022, and it’s clearly built mostly for fashion, home, and lifestyle. It’s not open to everyone. Sellers need approval, and their products must meet what Macy’s customers expect.

This Marketplace, like Walmart, is a large department store featuring broad categories like Women’s, Men’s, Beauty, Shoes, Toys, Jewelry, Handbags, Bed & Bath, Kitchen & Dining, Luggage, and Electronics.

Selling on Macy’s Marketplace involves a curated, invite-only process, with costs including a potential $0.30 listing fee, a 15% sales commission, and a $2.50 payment processing fee.

Macy’s has trust, a strong shopper base, and a huge loyalty program that drives most of the sales. Unlike Walmart, this isn’t a mass-market platform. There’s way less competition, but also less flexibility.

It’s a solid pick for polished products that match Macy’s core categories. But if you’re looking to move volume fast or launch aggressively, Walmart still gives more room to scale. Macy’s is about positioning, not speed.

Mercado Libre

If you’ve ever thought about expanding into Latin America, Mercado Libre is probably already on your radar. It’s basically the Amazon of the region, and honestly, it lives up to that name. We’re talking about 200+ million active users across countries like Brazil, Mexico, Argentina, and more. Like Walmart, it has a wide range of categories – Vehicle Accessories, Agriculture, Food and Beverages, Pets, Antiques and Collectibles, Art, Bookstore and Haberdashery, Cars, Motorcycles and Other Vehicles, Beauty and Personal Care, and more.

What everybody likes about it is how much is already built in. You don’t need to figure out shipping or payments from scratch – Mercado Envíos and Mercado Pago handle both. That means you can sell, get paid, and ship without juggling five different services. And with the “Mercado Shops” feature, it’s even possible to build a standalone storefront while still keeping all the perks of the main platform.

If you’ve got the logistics dialed in and a product that fits these markets, Mercado Libre can be a serious growth channel. It’s not as simple or familiar as Walmart, but the potential reach is massive.

Rakuten Ichiba

Selling in Japan? Rakuten Ichiba is where you start. It’s the biggest online marketplace in the country, with around 100 million users and a massive share of Japan’s e-commerce market. Buyers here are loyal – they actually prefer Rakuten over Amazon in a lot of cases.

One thing that sets Rakuten apart is control. You can build a fully branded storefront, customize banners, layouts, messaging – none of that generic marketplace look. And Rakuten doesn’t sell its own products, so you’re not competing with the platform itself like on Walmart or Amazon. But the onboarding process is slow and pretty strict. Most sellers need a local entity or partner in Japan, and the whole thing’s in Japanese.

It also has strong seller tools – ads, email campaigns, loyalty programs – plus weekly payouts to help with cash flow. You can really build long-term relationships with customers here. Selling on Rakuten Ichiba involves a mix of upfront and recurring fees, including a ¥60,000 Registration Fee, a ¥50,000 Monthly Fee, plus variable Commissions (2-20% depending on category), Payment Processing (~2.5-3.5%), Rakuten Points (1%), and Affiliate Fees.

Still, if Japan is part of your expansion plan and you’re serious about brand building – not just quick sales – Rakuten is worth it.

Target Plus

Target Plus isn’t your typical open marketplace. It’s an invite-only platform that lets Target handpick the brands it wants. Launched in 2019, it now features around 1,500 sellers. Mostly in home, furniture, specialty apparel, and other non-core categories, where Target wants more variety.

What makes it appealing? First, limited competition. If your product is approved, it may be the only one of its kind on the platform. That means better visibility without getting buried under dozens of similar listings. Second, the audience. Target.com brings in about 200 million monthly visits. Your products are shown next to established national brands, and that association adds trust.

Target Plus categories cover a wide range, complementing Target’s core offerings with unique, premium, and trending items in areas like Home Goods, Electronics, Apparel, Beauty, Baby, and Food/Essentials.

Sellers don’t pay listing or subscription fees. Just a clear commission per sale. Target also handles returns, which takes pressure off your support team. High performers might get featured in campaigns – or even considered for in-store placement.

Connecting It All with M2E Cloud

Selling on Walmart or any of its competitors is not just about listing products. The real work starts when you need to keep inventory, prices, and orders in sync across several marketplaces without losing control.

With M2E Cloud, you choose one primary source of product data. It can be your M2E Catalog or your e-commerce platform, such as Shopify, WooCommerce, BigCommerce, Adobe Commerce, Ecwid, Shopware, Salesforce, and more. From there, you push the same products to Walmart and other marketplaces rather than rebuilding every listing from scratch for each channel.

If you already sell on Walmart through M2E, adding new marketplaces is much easier. M2E Cloud keeps your catalog, listings, orders, and prices aligned, so you can scale from one marketplace to many without adding a new layer of manual work every time you expand.

If you need help with Walmart onboarding or listing setup on Walmart or other marketplaces, our team can support you. Just reach out to us, and we will walk you through the process.

Marketplace Fees 2025: What It Really Costs to Sell on Each Platform

Before jumping into any marketplace, it’s smart to understand the cost of doing business. Subscription fees and referral cuts. Below is a side-by-side breakdown of how Walmart Marketplace stacks up against Amazon and other platforms in terms of pricing and commission for professional sellers.

| Marketplace | Subscription Fee | Referral/Commission Fee |

|---|---|---|

| Walmart | None | 6-15% (category-based referral fees) |

| Amazon Marketplace | $39.99/month (Professional plan) | 8–15% (up to 45% in accessories) |

| eBay | None (Business account available) | 10–15% final value fee |

| TikTok Shop | None (Business onboarding required) | 5–15% typical, up to 15.66% depending on product type |

| Temu | None | – |

| SHEIN Marketplace | None | 15–25% standard (0% for first 90 days) |

| Macy’s Marketplace | None (For approved vendors only) | 15% flat + $0.30 per listing |

| Target Plus | $30/month subscription | 5–15% or 8–15% referral by category |

| Etsy | None (Pay-as-you-go for listings) | 6.5% + $0.20 per listing |

| Mercado Libre | None (Local entity or partner required) | 16–17% typical by country |

| Rakuten Ichiba | ~$39/month (Store account) | 8–15% (high competition tiers) |

Conclusion

The e-commerce landscape in 2025 is highly competitive and diverse. Amazon remains the global leader, but Walmart faces challengers on all fronts: general marketplaces like eBay and Target Plus, specialty platforms like Etsy, and new entrants like TikTok Shop and Temu. International players dominate their regions and offer global opportunities.

Each platform has unique strengths (audience demographics, favored categories, logistics networks). The result is a richer ecosystem. Walmart’s competitors keep innovating in fees, fulfillment, and technology. So sellers have more channels than ever to reach customers.